The Supreme Court in its recent order dated March 10, 2022 refused to allow a major daughter born to the couple to claim education and marriage expenses from her father after she said that she does not want to maintain relationship with him.

The top court was passing a decree of divorce on the ground of irretrievable breakdown of marriage.

Case:

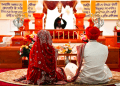

Couple got married in 1998 and a daughter was born in 2001. The daughter is 20-years-old as on date.

The apellent husband informed court that his respondent wife and their child were not living with him since 2002. The appellant had also filed a petition for restitution of conjugal rights under Section 9 of the Hindu Marriage Act, 1955 but the same was dismissed on default on 07.10.2004.

According to the respondent wife, she was allegedly tortured for dowry, harassed and thrown out of her home, thus she was living at her father’s residence.

Supreme Court

A bench comprising Justice Sanjay Kishan Kaul and Justice MM Sundresh exercised its powers under Article 142 of the Constitution to dissolve the marriage since the parties had separated over 18-years ago and the marriage was practically dead.

The matter was settled after it was referred to mediation before the the Supreme Court Mediation Centre. The Court had earlier put a condition to the husband that decree of divorce can be passed only if he agrees to bear the educational expense of his daughter. The Court also facilitated a meeting between the father and the daughter at the mediation centre.

However, the mediation was a failure and the mediator reported that the interactions between the parties had become “acrimonious and unpleasant”. In that backdrop, the Court observed in the order passed in December 2021.

The daughter, who is now aged about 20 years, would have to develop some interaction with the appellant-father if she wants him to play a role in her education.

Father Not Responsible For Finances If Daughter Does Not Want To Maintain Relationship

The Court noted that the daughter, aged 20 years of age, was not intending to maintain ties with the father. If that be the case, she can’t claim any amount from him for marriage and education, the Court noted in the order.

Husband Must Pay Alimony

At the same time, the Court clarified that it will ensure that that sufficient funds are available with the mother to support the daughter (if the mother so desires) while determining the amount to be paid by the father to the mother as permanent alimony. The Court fixed the permanent alimony of the respondent(wife) at Rs 10,00,000 in full and final settlement of all claims.

The top court concluded,

In so far as the daughter’s expenses for education and marriage are concerned, it appears from her approach that she does not want to maintain any relationship with the appellant and is about 20 years of age. She is entitled to choose her own path but then cannot demand from the appellant the amount towards the education. We, thus, hold that the daughter is not entitled to any amount but while determining the amount to be paid as permanent alimony to the respondent(mother), we are still taking care to see that if the respondent so desires to support the daughter, funds are available.

ALSO READ –

“Major Unmarried Daughter Not Suffering From Any Physical Or Mental Abnormality Cannot Claim Maintenance From Father U/s 125 Of CrPC”

READ ORDER | ‘Kanya Daan’ Pious Obligation Of Hindu Father; Delhi HC Orders Man To Pay Rs 85 Lakh For Marriage Expenses Of Adult Daughters

Wife deserted husband; Divorce granted after 21-years by Calcutta HC

Daughters To Receive Family Pension Even Before Divorce Has Been Finalised – BJP Government

“My Daughter Who Left Her Husband’s Home Beats Me”; 68YR Old Father Approaches Delhi High Court For Protection

ALSO WATCH –

ScoopWhoop CEO Alleges Rs 7 Crore Extortion Demand After Anchor Files Sexual Assault Case

Join our Facebook Group or follow us on social media by clicking on the icons below

If you find value in our work, you may choose to donate to Voice For Men Foundation via Milaap OR via UPI: voiceformenindia@hdfcbank (80G tax exemption applicable)